Intellectual property (IP) rights in regenerative medicine (RM) are crucial for sparking innovation and staying ahead in a competitive market. Protecting inventions through patents and other IP rights encourages investment by giving inventors exclusive market rights. This also ensures that new advancements are eventually disseminated widely. Patents grant an exclusive monopoly for a set period motivating ongoing innovation rather than mere exploitation of existing inventions. European Patent Office’s case studies on IP strategy and management highlight that effective IP management involves building strong IP portfolios, navigating patenting processes, and leveraging strategic licensing agreements and patent pools.

Globally, the commercialization efforts in regenerative medicine must engage with varying IP regimes. The intricate and varied nature of regenerative medicine-based technologies calls for innovative IP strategies that extend beyond traditional pharmaceutical patents. Companies eager to secure patents in regenerative medicines, like Cellular Dynamics International, which raised substantial funds to advance stem cell research, highlight the importance of having a monopoly on the use of innovative technologies to recoup investments. This need is highlighted by the high concentration of patent filings in the USA, European Union, and Australia, pointing to the governance and equity challenges in the IP landscape of regenerative medicine.

Patent landscape analysis

Potential patentable invention in the field of regenerative medicine is complex due to the wide variety of specialized technologies involved. This complexity in regenerative medicine arises from the need to navigate various patents related to stem cell lines, culture methods and growth factors, which can create bottlenecks due to their interdependence. This diversity in technologies means that common patent strategies used in other pharmaceutical fields may not be applicable in regenerative medicine. Hence, understanding the stem cell patenting landscape and trends is crucial for identifying where patent proliferation may pose challenges and how to address technology access issues.

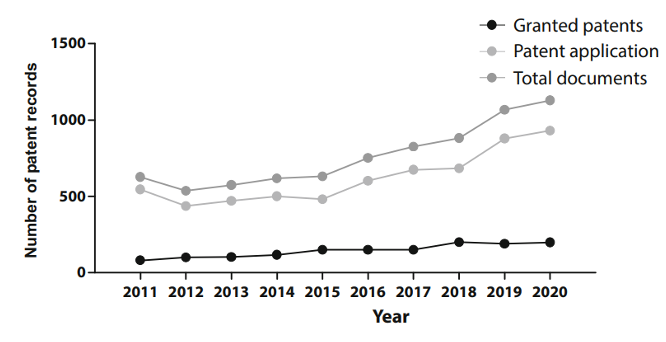

Let’s delve into the patenting trends in regenerative medicine by examining a comprehensive dataset of patent documents, including both applications and grants, from 2011 to 2020. As shown in Figure 1, the number of annual patent documents remained relatively stable between 2011 and 2015. However, from 2015 onward, there was a noticeable rise in annual applications and grants, peaking in 2021. This upward trend over the past decade highlights continuous growth and innovation in this research field, particularly since 2015.

Several factors contribute to this shift, one of the most significant being the 2007 breakthrough in generating induced pluripotent stem cells (iPSCs) from human somatic cells. This milestone addressed ethical concerns associated with using human embryonic stem cells in medical research, as it allowed access to pluripotent cells without destroying embryos. The development of iPSCs opened up numerous opportunities for medical research, particularly in diagnostics, drug screening and regenerative medicine.

Figure 1Patent records (applications and grants) in stem cell therapies in the last decade.

Stem cell patenting activities by country

The UK IP Patent Office’s informatics team analyzed the patent landscape from 1991 to 2011, focusing on the country of origin for regenerative medicine inventions. They found that approximately half of the global regenerative medicine inventions originated from the U.S., with around 3,650 patent families. Japan was the second major applicant, with about 750 families. The grant rate across all countries was roughly 30 per cent. The report also compared this to the broader life sciences field, where the U.S. led significantly with about 470,000 patent families, followed by Germany with 100,000. The patenting activities in other emerging countries, including Australia, Canada and China, exhibited lower shares of inventors and assignees relative to their patent offices’ shares of published stem cell documents, indicating substantial net inflows of stem cell filings by foreigners. Overall, the life sciences sector had 1.7 million patents, while the regenerative medicine sector had just over 20,000 patents, forming nearly 7,500 families.

Distribution and concentration of stem cell patent ownership by sector and assignee

Based on the analysis conducted by Karl Bergman and Gregory D Graff, the ownership of stem cell patents is divided between public and private sectors, which influences the accessibility and management of IP. Public sector institutions like governments, universities and non-profits often collaborate to manage IP collectively, which can reduce transaction costs and improve technology dissemination. In the U.S., public sector entities hold 44 per cent of stem cell patents, while private companies and individuals own 48 per cent. In Europe, the public sector’s share is lower at 30 per cent, with the private sector holding 70 per cent.

The ownership landscape is fragmented, with both public institutions and private companies holding diverse portfolios. Major private companies like Amgen, Novartis, Pfizer and GlaxoSmithKline have substantial stem cell patent holdings, often through mergers and acquisitions, despite not being primary players in stem cell research. This fragmented ownership contrasts with more consolidated industries, such as agricultural biotechnology, where a single company like Monsanto can hold a significant share of patents.

Impact of IP on investment and funding

One of the roles of IP in the biopharmaceutical sector is shaping investment and funding dynamics within the regenerative medicine sector. Patents provide a legal framework that protects the rights of inventors, thereby encouraging companies and researchers to invest significant time and resources into stem cell research. The exclusivity granted by patents can drive innovation and competition within the biotechnology industry, leading to rapid advancements and the development of novel stem cell therapies. This competitive environment is fueled by the potential for commercializing stem cell therapies, which involves navigating clinical trials, regulatory approvals, and eventually marketing the therapies to patients.

IP is especially crucial in the life sciences industry due to the high up-front costs associated with discovering and developing new drugs, long development timelines, and stringent regulatory frameworks. The high failure rate and the risk of duplication, once a drug is on the market, necessitate strong IP provisions to attract investors. Without these provisions, companies would be reluctant to invest in the research and development essential for producing life-saving drugs and vaccines. Studies estimate the costs of developing a new drug to range between U.S. $1 and $2.6 billion, underscoring the financial stakes involved. IP laws enhance the possibility of attaining a return on investment through market exclusivity, making the sector more attractive to venture capitalists and other investors.

The UK Parliament indicates the importance of patenting in the commercialization of regenerative medicine is underscored by its role in securing investment. A granted patent is often viewed as a key asset for start-up firms, demonstrating the potential for investment and facilitating the development of spinout companies or partnerships from academic research propositions. Without patent protection, business models in regenerative medicine may struggle to move beyond offering expert services, which are harder to commercialize. Patents make it illegal for anyone other than the owner or someone with the owner’s permission to make, use, import, or sell the invention, thus providing a significant lever in attracting private investment by ensuring a potential return on investment.

Patent landscape in Canada

The Institute of Health Economics highlighted that Canada is a global leader in patent filings in regenerative medicine, ranking second in the number of patents per capita from 2005 to 2015. Despite this impressive achievement, Canada struggles with the commercialization of IP. The country ranks much lower in the ratio of patents filed to new companies created and the commercial scale-up of IP, as measured by the number of employees per created company. This indicates a significant gap between laboratory discoveries and their development into clinical trials and commercial products.

Although there has been a recent positive trend in the commercialization of regenerative medicine in Canada, the environment remains challenging for establishing and growing sustainable companies. Some successful companies have relocated from Canada to the U.S., drawn by better investment opportunities, a strong pipeline of highly qualified personnel, emerging business expertise, and less risk-averse investment conditions. This migration underscores the need for Canada to focus not only on research and IP generation but also on factors that support commercialization efforts, such as manufacturing, favourable tax policies, and clinical delivery capacities.

Gene therapy products are patentable in Canada and subject to the same legislation as other patented products, according to Norton Rose Fulbright. Notably, five of the 10 approved gene therapy products in Canada have patents listed on the Patent Register. This signifies an active engagement in protecting IP in this innovative field. Additionally, by January 1, 2025, Canada will implement a system of general patent term adjustment (PTA) to compensate patentees for unreasonable delays by the Patent Office in issuing a patent. However, if a patent has a certificate of supplementary protection (CSP) and an additional PTA term, the two extensions will run concurrently, potentially limiting the total extension period.

If you’d like strategies for your IP management, read Part 2: Strategic IP management in RM: Enhancing innovation and overcoming patent challenges.

Comments