When Signals first burst onto the scene in 2012, the potential of the regenerative medicine industry still hadn’t set in for many. When the Alliance for Regenerative Medicine (ARM) published its first state of the industry report in 2012, the ARM chairman at the time, Gil Van Bokkelen, wrote that “few people have the desire or will to take on challenges so enormous they could fundamentally change the world for the better, and fewer still have the opportunity to actually do it. The Alliance for Regenerative Medicine represents an industry with the will and the opportunity to change human health.”

Today this will is widespread, and the opportunity is widely recognized — that is, if funding flowing into the sector is anything to go by. A sea change has taken place and the industry stands strong, backed by the private equity it will need to achieve its audacious goals. Let’s take a closer look at this shift, comparing industry snapshots captured a decade ago by ARM and the California Institute for Regenerative Medicine (CIRM), with the state of the industry today.

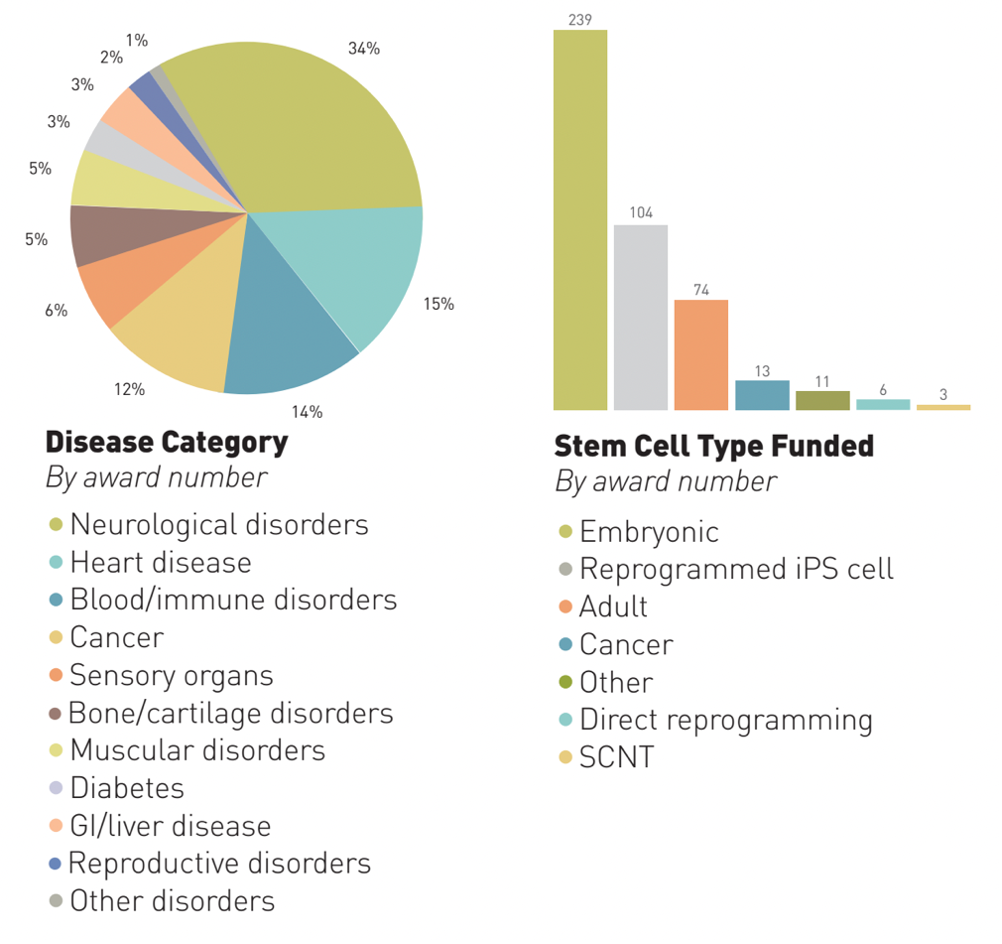

2012 saw a flurry of activity in regenerative medicine. Late- mid- and early-stage clinical trials across the industry had enrolled more than 17,000 patients, according to ARM, which estimated the industry to include more than 700 companies focused on regenerative medicine technologies and services. For an idea of which technologies were promising enough to secure R&D funding back in 2012, let’s look at where CIRM —the largest regenerative medicine funder in the world at the time — awarded its cash.

CIRM committed USD$307 million to regenerative medicine projects that year, bringing the total funding commitment of the institute to USD$1.7 billion. Projects targeting neurological disorders secured the biggest slice of the pie, and we can see from the second graph just how popular technologies taking a cell-programming approach were.

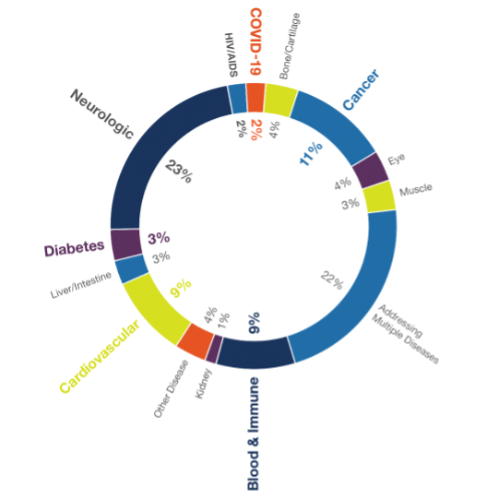

Compared to the “total grants awarded by condition” graph in CIRM’s most recent annual report, we can see that although projects targeting neurological conditions still came out on top, representing 23 per cent of grants awarded, not far behind with 22 per cent of grants were projects targeting multiple diseases. This trend is reflected in a recent episode of the CCRM podcast, when Dr. George Church explained that he was most excited about lines of investigation that can address multiple diseases at once by targeting the mechanisms of aging.

Compared to the “total grants awarded by condition” graph in CIRM’s most recent annual report, we can see that although projects targeting neurological conditions still came out on top, representing 23 per cent of grants awarded, not far behind with 22 per cent of grants were projects targeting multiple diseases. This trend is reflected in a recent episode of the CCRM podcast, when Dr. George Church explained that he was most excited about lines of investigation that can address multiple diseases at once by targeting the mechanisms of aging.

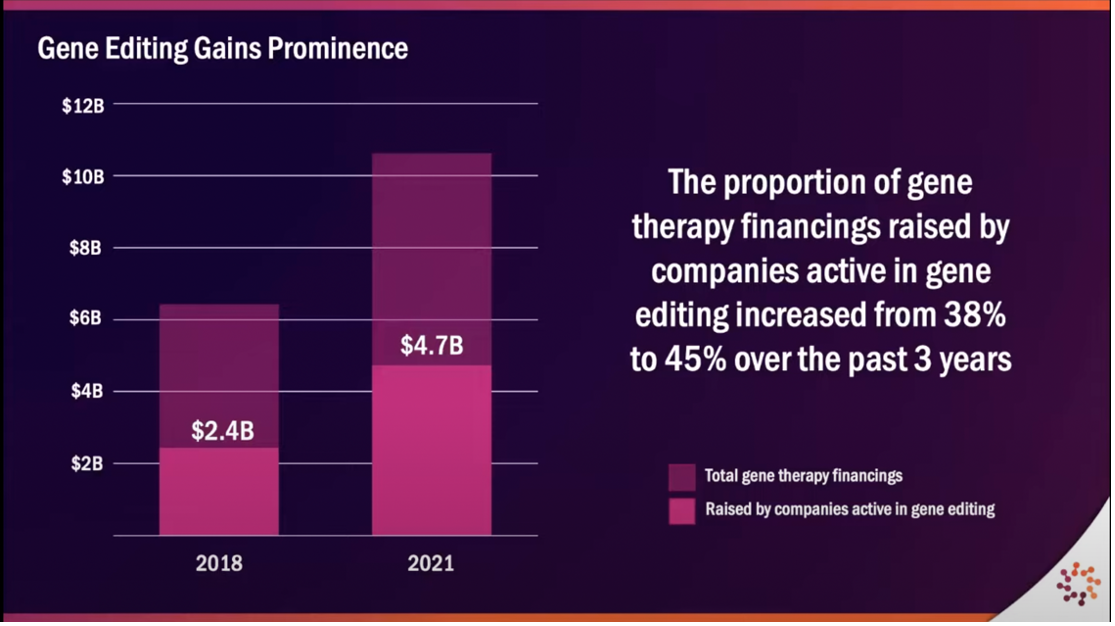

Whereas cell programming approaches secured the majority of funding in 2012, by looking to data from the ARM 2022 Cell & Gene State of the Industry Briefing, we can see that gene editing has gained prominence, accounting for more than 1/3 of sector-wide funding raised in 2021. Much of the excitement in this space has been catalyzed by Intellia Therapeutics reporting positive early data on in vivo CRISPR therapy.

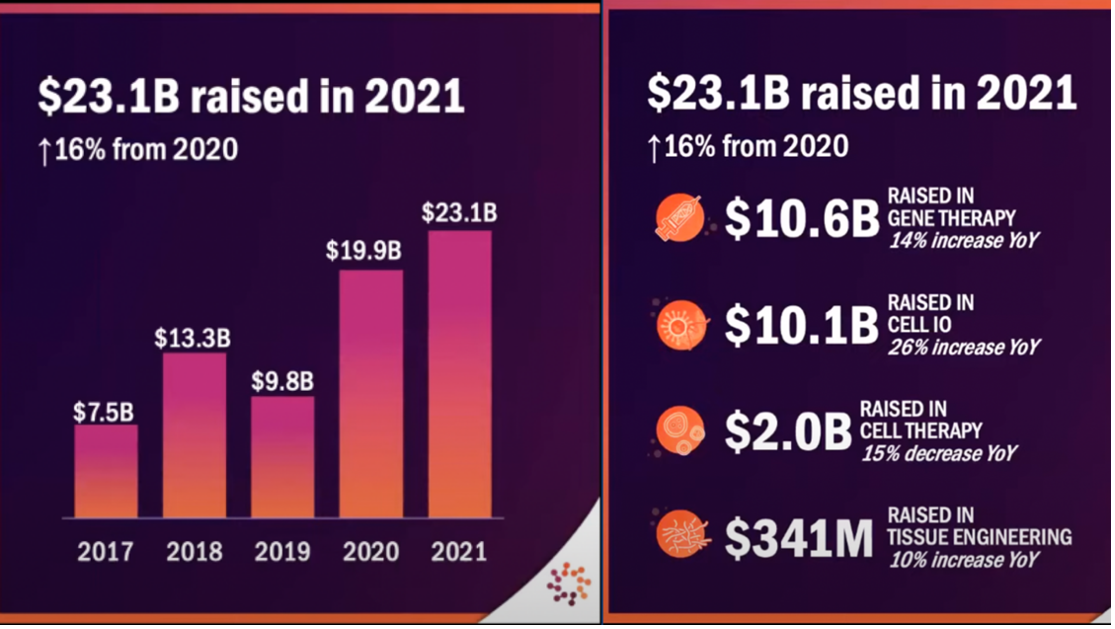

Courtesy: ARM 2022 Cell & Gene State of the Industry Briefing presentation, January 2022

The next big trend to consider is the deluge in private equity funding, signalling regenerative medicine’s ever solidifying place in the future of medicine. Private investment looks set to continue pouring into the sector with each year reaching new, unprecedented heights. CIRM’s most recent annual report highlights that new private funding has increased from USD$45.5 million in 2015 to more than USD$5 billion in 2020. This is echoed by ARM’s data which show industry funding skyrocketing from USD$7.5B in 2017 to USD$23.1B in 2021.

Courtesy: ARM 2022 Cell & Gene State of the Industry Briefing presentation, January 2022

In another recent CCRM podcast episode Dr. Cynthia Lavoie, President and Chief Investment Officer, CCRM Enterprises, explained that investors are bullish about the field as more technologies approach the finish line. According to the ARM 2022 Cell & Gene State of the Industry Briefing, the year ahead is set to herald regulatory decisions made on as many as nine cell and gene therapies.

It’s difficult to predict where the next 10 years will take the sector but Janet Lambert, Chief Executive Officer at ARM, thinks we’re on the cusp of “an even larger breakout,” pointing to the more than 2,600 trials ongoing worldwide — including 1,320 industry-sponsored trials by nearly 1,200 companies — with 243 of those in Phase 3. Read Janet’s “Acceleration On All Fronts” foreword in the 2021 ARM industry report for more, and then check back with Signals in 2032.

Cal Strode

Latest posts by Cal Strode (see all)

- What’s in the mix for 2026: ARM’s State of the Industry briefing - January 28, 2026

- World AIDS Day: Update on HIV cure research and gene therapies - December 1, 2025

- Headwinds and tailwinds for cell and gene therapy under the second Trump administration - March 11, 2025

Comments