2025 marks the third time I’ve covered the Alliance for Regenerative Medicine (ARM) State of the Industry Briefing for Signals. In 2024’s installation, I noted the strong emphasis on the cell and gene therapy (CGT) industry’s acceleration, driven by scientific advances bringing meaningful developments for patients. This year, I noticed a remarkable paradigm shift as the 2025 briefing signalled the industry’s coming maturation and scalability, stemming from expanding commercial potential for CGTs to reach broader patient groups, regulatory innovation, and increasing investment despite headwinds in capital markets.

“Today, 75 per cent of the global revenue comes from less than 10 products, that’ll move to 50 products by 2030,” said Tim Hunt, CEO, ARM, sharing Deloitte’s analysis of Wall Street consensus data. “A big maturation of the field is coming, in real-time.”

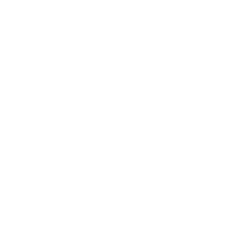

Acknowledging industry challenges, Mr. Hunt drew parallels to the non-linear path to success that monoclonal antibody treatments took, reminiscing how veteran industry leaders would share “what a slog it was trying to raise money, trying to get partnerships.” Fast-forward to 2024, these treatments have benefited millions of patients worldwide and brought in annual revenue of ~US$250 billion.

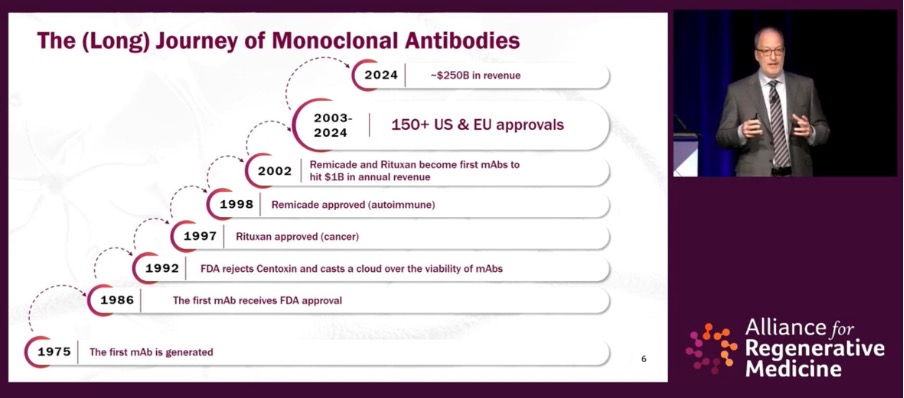

The parallel is apt, but for CGTs progress has been markedly accelerated considering time between the first approval and maturation of the technology (see timeline below). Mr. Hunt observed that “we’re already knocking on the door of the 2019 prediction shared by Scott Gottlieb,” the former U.S. Food and Drug Administration (FDA) Commissioner who predicted that we would see 10 CGT approvals a year by 2025.

Mr. Hunt reflected that this milestone could be assigned to 2024 if we were to include Casgevy’s approval for beta thalassemia (a genetic blood disorder where the body produces less hemoglobin than normal). However, ARM and others in the industry typically count first approvals only, leaving us with nine for 2024 – Casgevy was first approved for sickle cell disease in December 2023.

The briefing showcased important signs of growth, with a rise in CGT developers (6 per cent), clinical trials (3 per cent) and investment (30 per cent), and while the U.S. still has the lion’s share of each, Mr. Hunt was keen to impart that CGT is by no means “just a U.S. business.”

“Today, 35 per cent of the worldwide revenue from cell and gene therapy comes [from] outside the U.S.,” said Mr. Hunt, before sharing a presentation slide featuring products with a majority of their revenue coming from outside the U.S. (Zolgensma 68 per cent, Yescarta 54 per cent, Luxturna 58 per cent, and Kymriah 80 per cent). It’s worth noting that all of these therapies are owned by larger companies (Novartis, Gilead, Roche, and Novartis respectively) that have the scale and infrastructure to achieve international market presence, underlining the importance of partnerships for smaller biotechs wishing to commercialize a treatment.

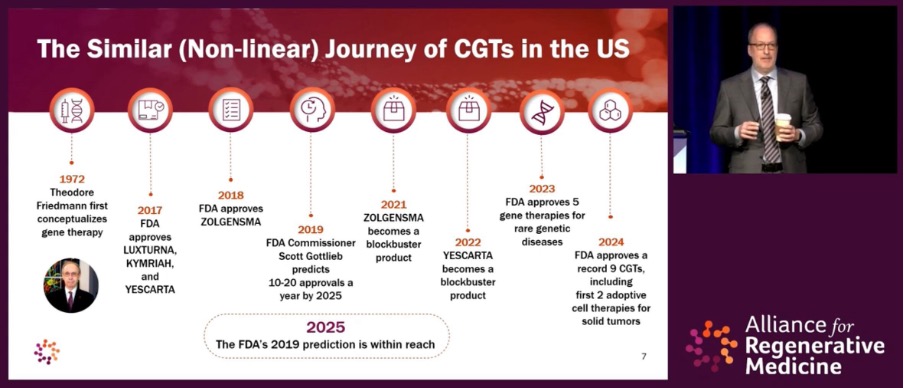

Estimates presented by ARM place the industry on a trajectory of moving beyond breakthrough treatments for smaller patient populations, to prevalent disease breakthroughs that could benefit tens of millions of patients with conditions including diabetes and Parkinson’s. The realization of this goal will undoubtedly further accelerate the globalization of the CGT industry, as the infrastructure necessary to deliver these groundbreaking treatments to patients worldwide is established.

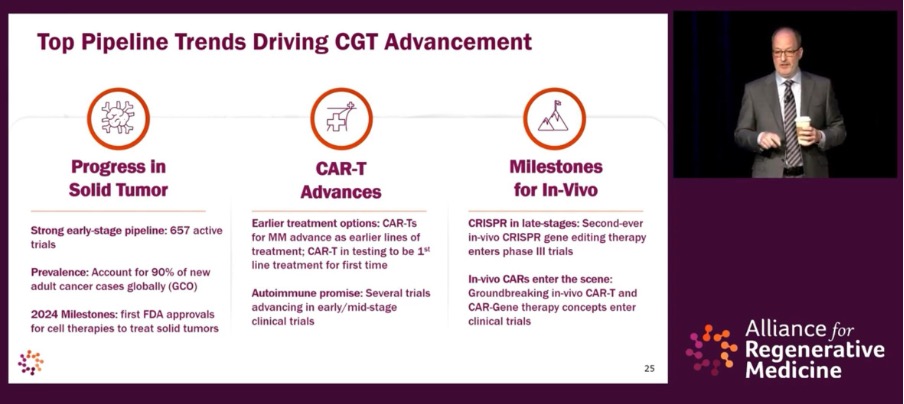

In terms of “top pipeline trends” driving CGT advancement, the briefing highlighted progress in solid tumour therapies, with a strong early-stage pipeline of 657 active trials for solid tumours – critical as these account for 90 per cent of new adult cancer diagnoses.

“The future is here,” said Mr. Hunt. “There’s a lot that is coming, but we’re seeing breakthroughs right now.” CAR T is in testing to be a first-line treatment for the first time, and several trials are advancing in early/mid-stage trials for indications including lupus and multiple sclerosis. In-vivo milestones were also spotlighted (see presentation slide below).

From ARM’s briefing, it’s clear that the promise of CGTs is widely recognized despite headwinds in capital markets. Not surprisingly, 13 of the 15 largest biopharma companies by market capitalization are investing in the development and/or commercialization of CGTs.

The importance of not paying too much heed to industry rumours was also emphasized when Mr. Hunt recalled the old adage, “…a lie is travelling halfway around the world when the truth’s just getting its boots on!” As a case study, Mr. Hunt pointed to rumours that Novartis was “getting out of cell and gene therapy,” but these were quickly dispelled when the company acquired Kate Therapeutics in a deal worth up to US$1.1 billion. “A lot of these myths and questions are usually one deal away from turning the narrative around on its head fairly quickly,” Mr. Hunt reminded attendees.

Updates on FDA’s efforts to accelerate advances in CGT from Dr. Peter Marks

In August 2023 and January 2024, I covered the work Dr. Peter Marks, Director, Center for Biologics Evaluation and Research (CBER), is spearheading in the FDA to accelerate CGTs. Since then, significant progress has been made on the two CBER pilots previewed:

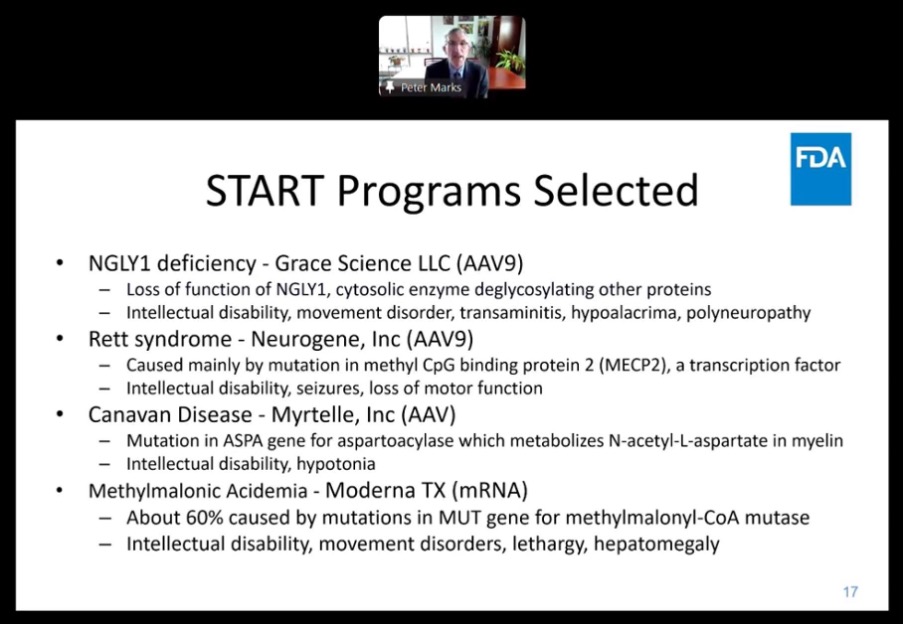

- The Support for clinical Trials Advancing Rare disease Therapeutics (START) pilot is now a reality. With the first four programs having been chosen, they will now receive “concierge service” styled enhanced communication with CBER. Dr. Marks shared that the programs selected all target “relatively severe diseases,” and developers included in the pilot are a range of sizes.

- The Collaboration on Gene Therapies Global (CoGenT Global) pilot is also progressing, underlining the FDA’s commitment to harmonizing international standards to streamline approvals and expedite international patient access. Dr. Mark’s team now has a pilot ongoing with the European Medicines Agency to explore enabling concurrent regulatory reviews “so that a single application could be submitted to multiple regulators, and potentially be reviewed collaboratively by those regulators, so that there is less re-work,” explained Dr. Marks. “The potential to have essentially one-stop for these types of rare disease products could hopefully allow patients in multiple regions to benefit because what starts out from a non-commercially-viable market in one country could suddenly become a very viable market if you are able to introduce into multiple countries simultaneously without very much extra work.”

Looking at the past year, Dr. Marks said that “2024 was a good year for gene therapy approvals,” pointing to T-cell therapies becoming a workhorse of hematologic malignancies (cancers that affect the blood, bone marrow or lymphatic system) and predicting that we’ll soon see these therapies becoming a workhorse in the auto-immune space too.

In terms of regulatory challenges, Dr. Marks shared that “self-designation is not really working as well as we would like it to; some are self-designating under, so that they are under-regulated, and other products we’re clearly over-regulating – an example might be pancreatic islets – and so we are exploring a risk-adapted framework.” Dr. Marks noted that this is not fully formed, and that the FDA will host a workshop on February 25, 2025, to hear from industry and academics to plot a way forward. You can find out more and register to attend on the FDA website.

With record-setting approvals, global regulatory collaboration, and scalable technologies on the horizon, the future of CGT is brighter than ever. Progress may not be linear, but with patients as the industry’s North Star, 2025 promises to bring life-changing therapies to more people worldwide.

Cal Strode

Latest posts by Cal Strode (see all)

- What’s in the mix for 2026: ARM’s State of the Industry briefing - January 28, 2026

- World AIDS Day: Update on HIV cure research and gene therapies - December 1, 2025

- Headwinds and tailwinds for cell and gene therapy under the second Trump administration - March 11, 2025

Comments