Bhavi Kadakia was an intern with CCRM Australia in 2020 and is currently employed at Novotech.

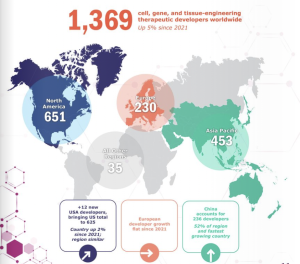

The Asia Pacific region has 453 developers, up 10 per cent from 2021. Image: Alliance for Regenerative Medicine H1 2022 (September) report

In the health-care sector, translation and commercialization have traditionally been described as complex and requiring heavy investment. As such, it is imperative for biotechnology companies to make the best use of their money and maximize the time to market, and this includes considering a location that is in their best interest.

Various factors should be considered when choosing where to conduct commercialization and translation work, such as: workforce skillset and expertise; basic research; translational infrastructure; clinical expertise and infrastructure; CDMOs; the regulatory tax incentive; and, nature of the market of the customers.

This blog will review an option that was presented at the BioMelbourne Network’s BioBusiness Insights webinar: “Opportunities in Asia – the South Korean perspective,” which was jointly organized by CCRM Australia. The session was presented by Professor So Ra Park from the Strategic Centre for Regenerative Medicine (SCRM), who gave an overview about the Korean stem cell and regenerative medicine market and provided details about the strength and size of the market, and the opportunities and challenges that exist.

In the search for an ideal location to translate and commercialize regenerative medicine products, the growing South Korean market should not be overlooked. The technological adoption and emphasis on research is accelerating in South Korea and it is one of the world’s fastest growing regions.

The presentation indicated that South Korea’s health-care market was worth US$0.05 billion in 2016 and is expected to grow to over US$0.32 billion by 2026, with a CAGR of 20.4 per cent compared to the global regenerative medicine market worth US$5.8 billion in 2016 and expected to grow to over US$308 billion by 2026, with a CAGR of 17.3 per cent during the same time frame. The Asian market overall is projected to grow from US$3.3 billion to US$47.3 billion by the year 2028. The South Korean market has the highest potential for development given its geographical location at the centre of the fastest growing health-care market in the world. South Korea’s market is not only growing but is growing faster than the global average, suggesting strong potential to provide biotechnology companies with more opportunities.

Moreover, South Korea accounts for 2 per cent of all clinical trials worldwide and is one of the countries with the most approved regenerative medicine therapies, supported by an attractive reimbursement rate where up to 95 per cent of medical costs are covered by health insurance. There are also lots of active financing opportunities and support from the government. For example, the South Korean government passed the Act on the Safety and Support for Advanced Regenerative Medicine and Advanced Biopharmaceuticals (Advanced Regenerative-Bio Act), which allows patients suffering from rare and incurable diseases to have access to new treatment opportunities. South Korea has offered an expedited process for approving novel therapies under circumstances where there are no alternative treatments for life-threatening diseases, and other reasons, including pandemics. These policies have been very beneficial for patients as well as biotechnology companies as they speed up the regulatory approvals.

A major driver of the growth in commercialization is South Korea’s ability to attract foreign investment. The annual Bio Korea conference is a good opportunity for building and discovering partnerships with various companies all over the globe. Austrade, the name of Australia’s trade mission, is very well placed to assist in establishing new or maintaining existing partnerships. There are many opportunities for support from Austrade as well as other state governments.

As Australia’s 4th largest trade partner, there exists a free trade agreement (KAFTA) between Australia and Korea that allows tariff elimination on nearly all of Australia’s current export products such as agricultural exports (for example beef, wheat, sugar, dairy, wine, horticulture and seafood) and tariffs eliminated on resources, energy and manufactured goods. This formal trade agreement has shown that Australia and Korea have already reached a common understanding and that common understanding has laid the foundation that can be expanded or encourage other agreements that may one day include trade of novel therapies, such as regenerative medicines.

As one can see, an international trade model between two countries is very beneficial. It makes sense for Australian biotechnologies to have access to markets such as the U.S., U.K., Japan, Israel and many more. South Korea, with its excellent R&D infrastructure for scientific and medical innovation, and research excellence, is very appealing to biotechnology companies and is a model for other countries to aspire to while developing their regenerative medicine sector. For any biotech that is seeking to maximize its limited resources and speed to market, having good sovereign commercial ties between countries, like the example here, can be a helpful conduit for regenerative medicine innovations and set local biotechs up to become global contenders.

CCRM Australia

Latest posts by CCRM Australia (see all)

- CCRM Australia: Lessons from the front line of commercialization - October 1, 2025

- CGTs in elite sport: The pinnacle of human evolution or the unnatural demise of fair competition? - April 21, 2025

- Learnings from First Nations’ traditional medicine could enhance the effectiveness of regenerative medicine - October 6, 2023

Comments