This year marks the fourth consecutive time I’ve covered the Alliance for Regenerative Medicine’s (ARM) State of the Industry briefing for Signals, and I’ve enjoyed tracking how the cell and gene therapy sector has evolved in real time. In 2023 and 2024, the briefings were defined by acceleration, scientific momentum, and the promise of breakthrough innovation beginning to translate into patient impact. The 2025 edition marked a turning point, signalling a shift from rapid expansion to maturation, scalability, and early commercial proof. In 2026, that transition feels complete. The tone of this year’s update was notably more grounded and confident, focused less on what could be possible and more on what is now working, what has been learned from missteps, and how discipline across science, regulation, and capital is shaping a more sustainable growth cycle for regenerative medicine.

”Beginning this year, the sector is entering a very disciplined, and we believe sustainable, growth cycle,” said Tim Hunt, CEO, ARM, noting, incidentally, that it’s his fourth anniversary delivering the briefing. Mr. Hunt outlined how the sector has absorbed difficult lessons from its first commercial wave and is emerging stronger, more selective, and better aligned with patients, regulators and payers.

The difficult lessons in question were early cell and gene therapies, which struggled commercially due to factors including small patient populations, safety concerns, intensive treatment regimens, and difficulties with access and reimbursement. All of these challenges were then compounded by investment headwinds. These realities forced a period of recalibration, but the optimism and trust in the potential of these revolutionary therapies never went away. Now, as we move into 2026, two-thirds of the thirty largest companies by market capitalization are investing in the development or commercialization of cell and gene therapies, according to ARM.

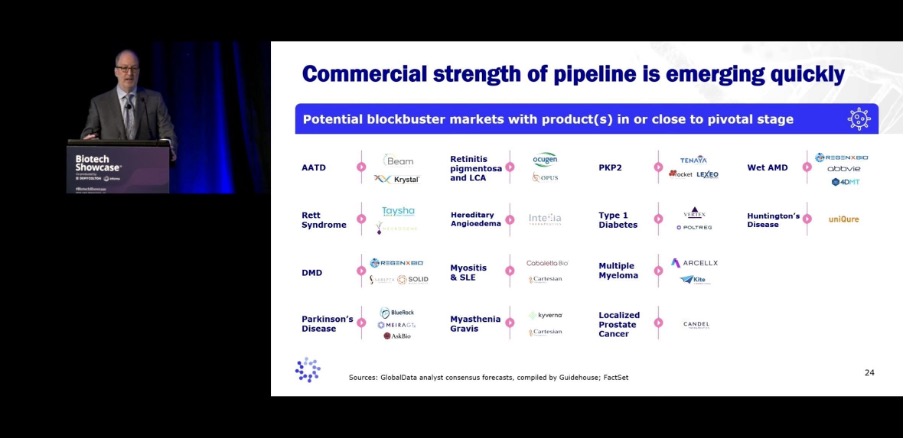

The message of this year’s briefing was that companies are now adapting with greater discipline. Approaches are being refined to improve safety, streamline manufacturing, and reduce burden on patients and health systems. With many therapies in the pipeline targeting high unmet need, there is potential to reach broad patient populations with conditions like Parkinson’s, diabetes and localized prostate cancer. That’s not to say that patients with rare diseases will be left behind, however, and I’ll come back to this point.

Patient impact

Perhaps the clearest signal of progress comes from patients themselves. “What better starting point than our ‘North Star,’ the impact that this sector … that all of you can have when things work well: our patient community,” said Mr. Hunt, introducing patient stories including Marci McCue. Marci was the first participant in a CAR T clinical trial for multiple sclerosis, and Baby KJ became the first person to receive a bespoke CRISPR base-editing treatment that was developed and tested in under seven months, saving his life from a rare genetic metabolic disorder.

Patients with rare conditions like Baby KJ look set to benefit from rapidly evolving regulatory frameworks, which are adapting to accelerate approvals through platform approaches, such as the FDA’s emerging “plausible mechanism” pathway. The core idea is that once a therapy platform has a well-understood and validated biological mechanism, regulators can rely on that existing evidence when assessing new products that use the same mechanism, enabling faster review without having to re-prove how the system works each time. This approach allows highly targeted treatments to be developed and approved more quickly and at lower cost, making therapies for very small patient populations viable where they otherwise would not be.

Global competition is accelerating regulatory modernization

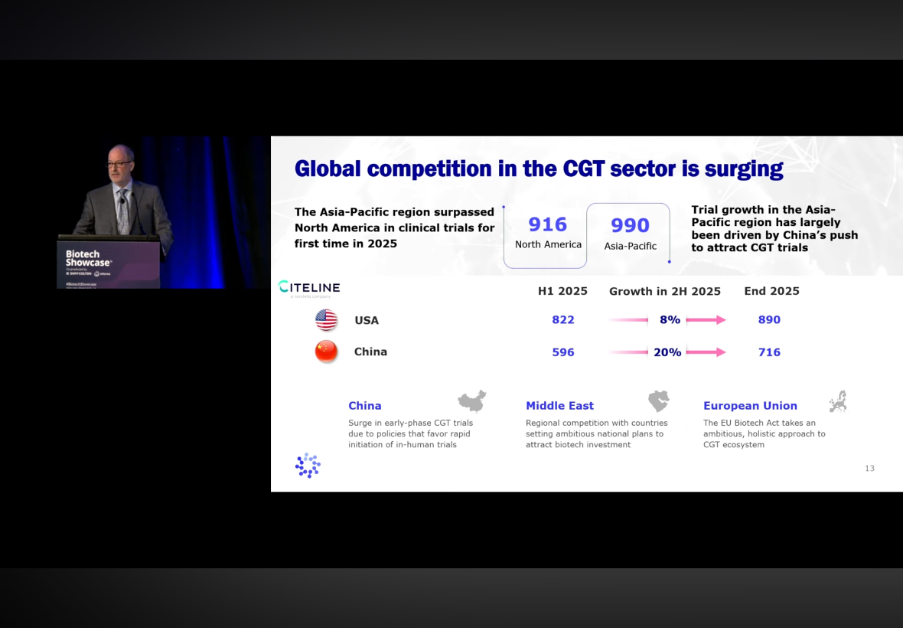

Much of this progress is being driven by global competition, which is acting as a powerful catalyst for system-level change. Cell and gene therapy (CGT) is now a truly global industry. In 2025, the Asia Pacific region surpassed North America in CGT clinical trial activity for the first time, driven largely by China’s policies favouring rapid initiation of early-stage trials.

Europe is also positioning itself more assertively. The EU Biotech Act, released in December 2025, marks a potential inflection point for the region’s CGT ecosystem. By aligning regulation, investment, and delivery, it proposes faster clinical trial starts, dedicated ATMP centres of excellence, enhanced intellectual property incentives, as well as significant new funding for early-stage companies.

“They properly recognize that the success of the sector depends on how regulation, investment, and delivery work together,” said Mr. Hunt, welcoming the EU’s shift from regulator to enabler. “The bigger point is, it’s a recognition that, in Europe, they really have to drive greater innovation to compete with North America and Asia.”

In the United States, there is a growing alignment between health policy priorities and the long-term promise of curative therapies. “They have told us repeatedly, and in many different forums, look, we believe that the Make America Healthy Again movement is highly aligned with what you guys are trying to achieve in the cell and gene therapy community,” said Mr Hunt, explaining that both share an ambition to move beyond cycles of chronic care and instead address the underlying root causes of disease. He added that this alignment is beginning to translate into action, with regulators showing greater openness to real-world evidence, more flexible development pathways, and policies designed to accelerate patient access to curative therapies, reinforcing the view that regenerative medicine is becoming an increasingly central pillar of a more sustainable health-care system.

Safety context matters and the data is reassuring

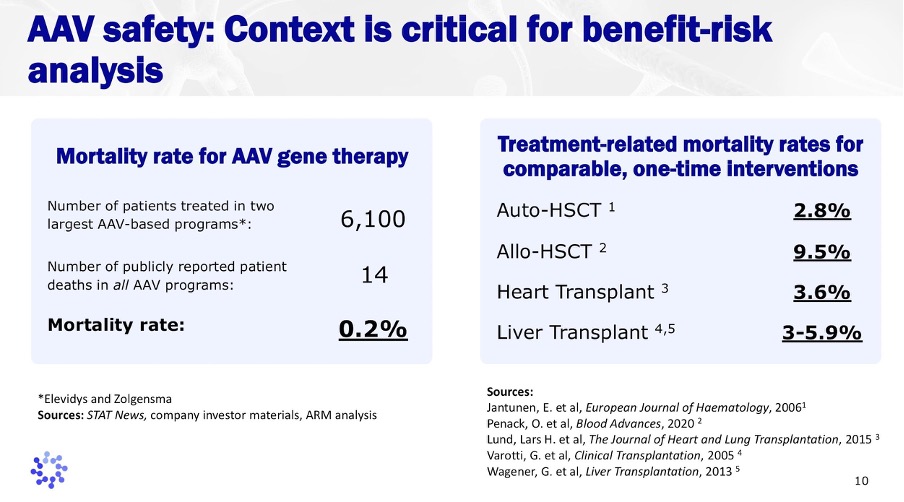

As therapies move closer to broader adoption, benefit-risk assessment has become more nuanced and data-driven. Across thousands of treated patients, publicly reported mortality rates remain low, especially when compared with other one-time, high-impact medical interventions such as organ transplantation or hematopoietic stem cell transplants.

A sector coming of age

Taken together, the signals – excuse the pun – from ARM’s 2026 update point to a sector that has come of age. Companies are learning and adapting. Investors and strategic partners are enforcing discipline while enabling growth. Regulators are modernizing frameworks to better accommodate transformative therapies. Commercial opportunities and, most importantly, patient impact, are expanding.

After four years of covering ARM’s State of the Industry for Signals, the change in tone this year was striking. The conversation has moved beyond proving that cell and gene therapy can work. Attention is now firmly on making it sustainable, scalable, and accessible to the patients who need it most.

Cal Strode

Latest posts by Cal Strode (see all)

- What’s in the mix for 2026: ARM’s State of the Industry briefing - January 28, 2026

- World AIDS Day: Update on HIV cure research and gene therapies - December 1, 2025

- Headwinds and tailwinds for cell and gene therapy under the second Trump administration - March 11, 2025

Comments